Going Once, Twice … Tribute Technology Sold to Carlyle Group and Vista Equity

Just six weeks after placing Tribute Technology on the auction block, Providence Equity Partners has reportedly sold the funeral home software company for more than $1 billion. According to PE Hub, Carlyle Group will maintain a majority stake in Tribute, with Vista Equity holding a minority position.

In September, Barron’s reported that Providence was shopping for buyers for Tribute Technology, which is a conglomeration of several deathcare companies including SRS Computing, Frazer Consultants, FrontRunner Professional, and AdPerfect. Providence’s 2018 spree of purchases of death-tech organizations led to widespread speculation about the equity firm’s intentions within the deathcare space.

The Tribute Technology umbrella

At first glance, the simple one-page Tribute Technology website portrays the company as an all-inclusive solution rather than a group of disparate deathcare units. Indeed, the site describes the company’s product offerings as a “comprehensive platform” that “brings together software and technology to provide a fully-integrated experience for all users.”

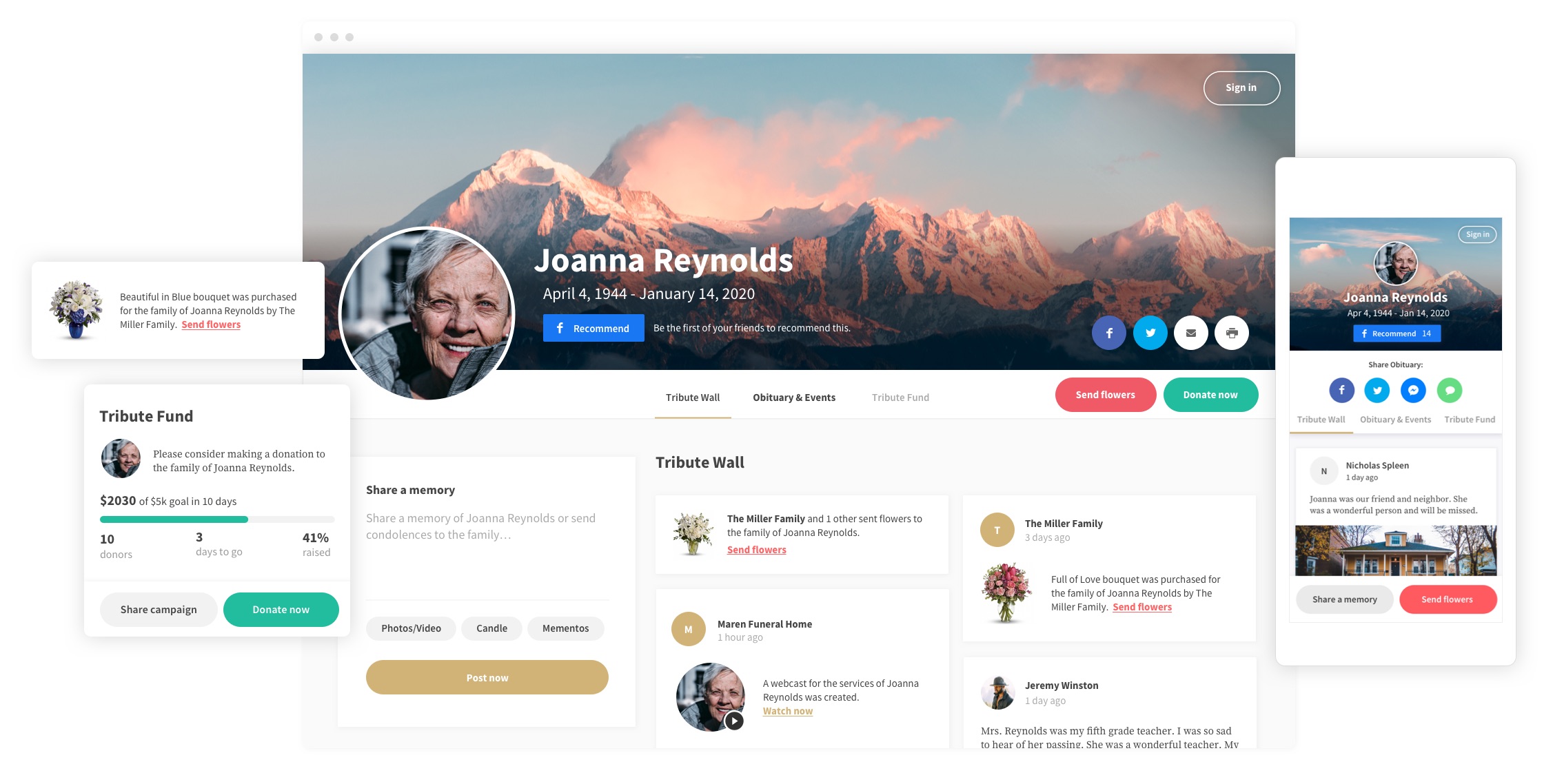

It seems that those companies that have been identified as being part of the Tribute Technology umbrella bring overlapping offerings to the table. Wexford, Pennsylvania-based SRS Computing specializes in cloud-based funeral home, cemetery, and crematory management software, including websites and payment and insurance assignment processing. FrontRunner Professional and Frazer Consultants offer similar technology plus social media and search engine optimization services, personalized products, and e-commerce options. According to one press release, more than 70% of U.S. funeral homes use at least one of these platforms.

AdPerfect is the latest addition to the Tribute Technology team. Prior to its acquisition by Providence, AdPerfect provided “mobile-friendly self-service advertising solutions for publishers and newspapers.” As part of Tribute, AdPerfect now offers a “self-service obituary engine” that “makes it easy for consumers to publish an obituary themselves” on a funeral home website.

Bargain or boondoggle?

As Funeral Directory Daily’s Tom Anderson said prior to the announcement of the sale, “A billion dollars is a lot of money.” Barron’s estimated that amount was approximately 18 times the EBITDA of the companies under the Tribute Technology umbrella. However, it’s not in the nature of investors like Carlyle and Vista to buy a boondoggle.

The Carlyle Group, founded in 1987, is a behemoth investment firm with $195 billion in assets, while Vista Equity Partners boasts “more than $58 billion in capital commitments and 20 years of investing exclusively in enterprise software.”

PE Hub reports that Tribute’s new backers are expected to “leverage its e-commerce functions to focus on growth through customer acquisition and customer engagement.” PE Hub’s source added that “Vista is anticipated to expand on these features by bringing on a new board member with relevant e-commerce experience.”

At the time of Tribute Technology’s announcement of its AdPerfect acquisition, Matt Frazer was cited as Tribute’s CEO. Frazer founded Frazer Consultants in 2003 and still serves as the organization’s President.

Connecting Directors will continue to follow this story and bring you details as they become available.