Prescreen Families for Financing and Enjoy a 101% Payout for Every Funded Loan Through LendingUSA

What do you look for in an at-need financing partner? Some things are a given, like full loan servicing at no risk to you and a simple application process, for example. Of course, you’ll want a program that benefits the families you serve, with exceptional customer service and flexible payment options. You’ll also want to see advantages for your own organization, like a knowledgeable support staff and a forward-thinking approach to technology.

What if we told you that there’s a company that offers all these things … plus a brand new pre-qualification process and a one percent bonus for every loan you get funded? Well, hold on to your trocars, because we’re about to introduce you to LendingUSA.

Actually, you might already be familiar with LendingUSA. After all, they’re endorsed by the National Funeral Directors Association (NFDA) and 12 state funeral organizations because they’re redefining point-of-sale financing with unprecedented benefits, thought leadership, and cutting-edge innovation. In fact, they’ve just introduced two mind-blowing perks that could change the way you approach conversations with your at-need families.

“I Love Talking About Financing” (Said No Funeral Director Ever)

Few funeral directors look forward to talking with at-need families about their payment options. It can be an awkward or embarrassing situation, especially when your conversation includes informing someone they don’t qualify for your financing program.

LendingUSA understands that bringing up payment in the best of circumstances is sensitive and difficult. LendingUSA wants to make it as easy as possible to break down those barriers.

That’s why LendingUSA recently unveiled FastScreen, a quick-and-easy way to prescreen a potential applicant to prequalify them for financing. FastScreen doesn’t require you to provide any sensitive information from an applicant and doesn’t involve a hard credit check, so it’s something you can complete before your arrangement meeting with a family.

FastScreen allows a merchant to do a quick prescreen of an applicant without their knowledge. After answering a few simple questions, you’ll get an answer immediately.

Having this information ahead of your meeting certainly helps to eliminate uncomfortable conversations. FastScreen also gives you a much better idea of what financing options you’re able to confidently offer. In essence, it gives you more opportunities to say “yes” to your families.

You Don’t Pay LendingUSA, But They DO Pay YOU

Switching financing providers or forming your first financing partnership isn’t something most funeral homes will take lightly. However, knowing there’s absolutely no cost to doing so definitely eases the process. There are no fees for signing up or for maintaining a membership. In addition, LendingUSA now offers its funeral loan customers a lower origination fee.

LendingUSA recently introduced an exciting 1% Earning Program* exclusively for their funeral loan merchants, whether you’ve been with them for years or are newly enrolled. In addition to a 100 percent payout from the loan, you get one percent back on every loan funded through LendingUSA.

Other new improvements include a higher maximum loan amount of $25,000 and more flexible loan terms of 36, 48 and 60 months.

A Provider You Can Trust With Your Families

In a profession where compassion, empathy, and kindness are crucial to your success, you wouldn’t trust your families to just any third-party provider. Don’t you want to know your customers are being treated with the same level of service they receive from you?

LendingUSA has earned not only an A+ Better Business Bureau (BBB) rating, but also accreditation from the BBB, as well as a 4.6-star average review on Google. Their loan origination customer service team is based in the United States and it’s easy to reach a real person with helpful answers.

LendingUSA gets positive feedback from customers who say it’s easy to work with the company, which should be important for funeral homes because when a funeral home offers LendingUSA, the services LendingUSA provides may be seen as a direct reflection on them, and it’s something LendingUSA takes seriously.

Feedback from merchant funeral homes is always considered, and has led to many of LendingUSA’s recent innovations, including the FastScreen service.

FinTech, Not Just Finance

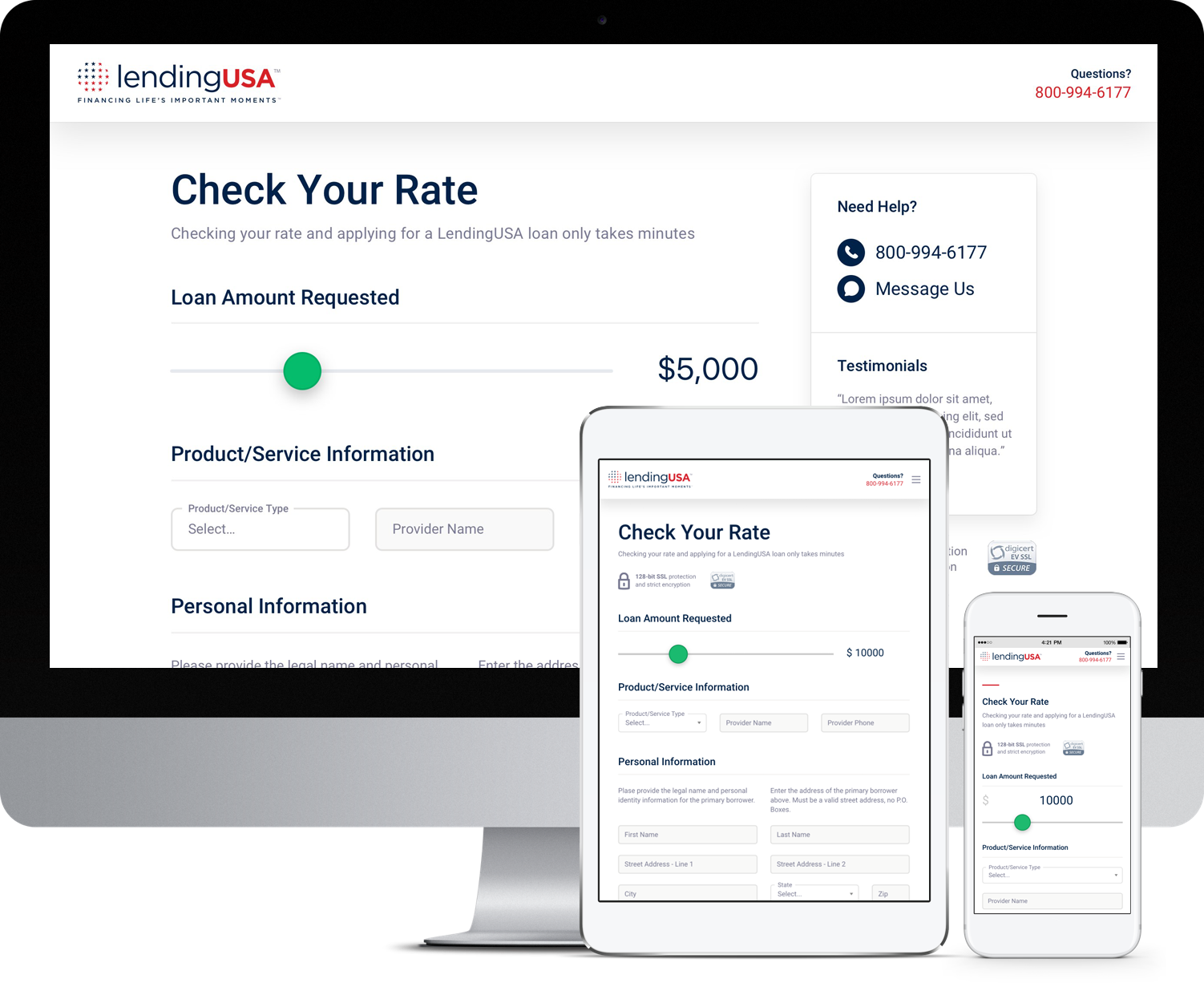

As a LendingUSA merchant, you can expect many more improvements like FastScreen in the future. After all, the company identifies as a financial technology company, not simply a finance company. This also means LendingUSA’s cloud-based portal is specifically designed to be easy for both merchants and customers to navigate.

This forward-thinking attitude, coupled with their commitment to responding to feedback, has also led LendingUSA to take on a thought leadership role in the deathcare financing space. For example, some funeral home merchants have asked for tips on talking about money with their families. To best answer those inquiries, LendingUSA delved into their ongoing research into deathcare statistics.

One area of research involves the changing demographics of funeral and preneed purchasers. Younger generations — Gen X and Millennials — have different perceptions of money, which leads to different conversations. LendingUSA wants to help you shift your approach to these conversations and support you and your funeral home. One way they do this is through educational opportunities, such as webinars offered through the NFDA and other organizations.

Their last webinar, presented by Kates Boylston, tackled the topic of shrinking margins resulting from rising cremation rates. To watch LendingUSA’s webinar How to Combat the Rise in Cremations and Margin Attrition for Years to Come on demand, click here.

To learn more about offering LendingUSA at-need financing to the families you service, request a free, no-obligation demo or call LendingUSA at 800-994-6177.

Sponsored

All loans are made by LendingUSA’s lending partners. Loans are not offered in all states. These materials are only directed to prospective merchants and not intended for consumers.

*Earn 1% of the amount financed of every point-of-sale funeral loan that funds directly to your business. Payouts are subject to loan cancellations and/or refunds. 1% Earning Program is subject to change or discontinuation without notice.