LendingUSA Survey: 70% of Funeral Professionals Reveal Families Are Less Prepared for Funeral Costs

SHERMAN OAKS, Calif. – According to a recent in-depth survey conducted by LendingUSA, families are unprepared for the cost of funeral services. In the survey, funeral homes across the United States were asked detailed questions and encouraged to share feedback about their perspective in their industry as funeral professionals. Their main challenge? The family’s budget.

Key takeaways:

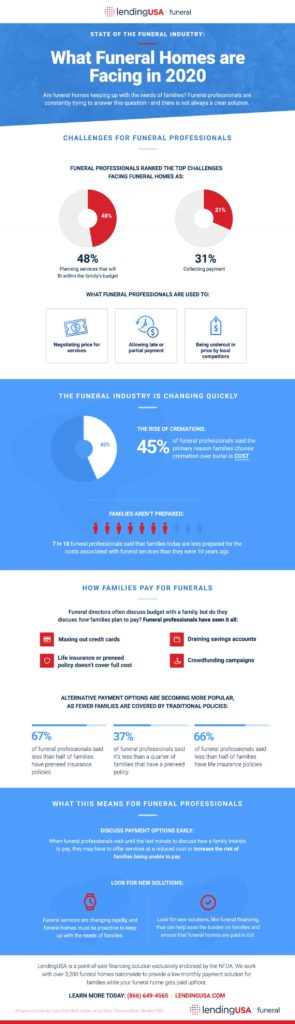

- 70% of funeral professionals said families are less prepared for funeral costs than they were ten years ago

- 48% responded that the top challenge facing funeral homes is “planning services that will fit within the family’s budget,” and 31% said “collecting payment”

- 45% of respondents revealed that the primary reason families choose cremation over burial is cost.

- 66% of funeral professionals said less than half of families have life insurance policies.

You can view the full survey results here. With fewer insurance policies, families must dig into dwindling savings accounts, max out credit cards, and start crowdfunding campaigns. When asked about their main challenges today, funeral homes answered planning services that fit within the family’s budget (48%) and collecting payment (31%).

This difficulty is amplified by the novel coronavirus (COVID-19) outbreak. As funeral homes scramble to acquire personal protective equipment and shift to small or virtual services, they’re also preparing for worst-case scenarios. Not only does this include bracing for a spike in demand, but also preparing for families who won’t be ready for the expense.

This leaves funeral homes today at a critical point. In addition to responding to a global pandemic, they’ll also be in a difficult position with the families they’re serving, knowing that few will have the ability to pay in full. As the world changes, funeral homes should remember to be ready to evolve and find new solutions. In addition to emergency preparedness, funeral homes can prepare for families by offering better payment options.

“Whether families need a low monthly payment or more time to gather funds, solutions are available that can help funeral homes get paid—and help families spread the cost over time,” says Camilo Concha, Founder & CEO of LendingUSA. “We’re proud to partner with our funeral homes to offer families a solution during this challenging time.”

About LendingUSA

LendingUSA is an award-winning fintech company that offers point-of-sale financing solutions to over 8,000 merchants nationwide serving various markets including the elective medical industry, legal, tax, pet, funeral and more. LendingUSA is committed to creating the best financing experience through its proprietary point-of-sale lending solution. LendingUSA works closely with its merchant partners, providing the tools and training they need to easily maximize customer financing approvals and grow their business.

All loans are made by Cross River Bank, a New Jersey state-chartered bank, Member FDIC. For more information, please visit www.LendingUSA.com