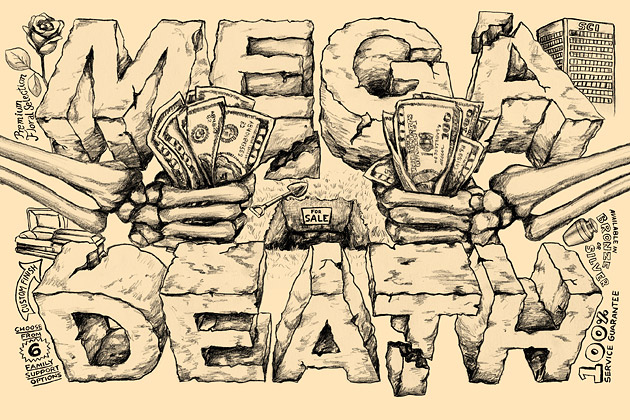

SCI Is Cover Story For Bloomberg Businessweek, Inside America’s Fastest-Growing Merchant of Death

Steering his jet-black Cadillac CTS sedan along the streets of West Palm Beach, Fla., Brad Zahn offers a tour of the area’s cemeteries, one more tropically lush than the next. Zahn, owner of the Tillman Funeral Home & Crematory, embalms and buries people for a living. He employs his wife, Maribel, and one of their adult sons. Another son attends mortuary school. “My succession plan is in place,” Zahn says. He speaks evenly and wears muted business attire. One hand on the wheel, he seems the very picture of a confident entrepreneur. His demeanor turns anxious, however, when I ask about the funeral chain Service Corporation International (SCI). “How can you not be nervous,” he responds, “when the 1,000-pound gorilla gets even bigger?”

In the death-care industry, as practitioners call it, SCI casts a long shadow. Based in Houston and publicly traded on the New York Stock Exchange (NYX), it operates more than 1,800 funeral homes and cemeteries in the U.S. and Canada. It has 20,000 employees and a market capitalization of $4 billion. For 40 years, SCI has gobbled competitors as the pioneer consolidator of a fragmented industry. Although it has overreached at times, suffering a corporate near-death experience after a late-1990s debt binge, SCI is hungry once again. “This summer they bought the Quattlebaums,” Zahn says, referring to an established family-owned funeral home catering to the Palm Beach elite. With that acquisition, SCI controls 8 of the 14 businesses Zahn considers rivals. “Then,” he adds, “there’s the Stewart deal.”

Already No. 1 in death care in North America, SCI expects by early 2014 to ingest the next-largest chain, Stewart Enterprises (STEI), based in New Orleans. In one gulp, SCI will grow to 2,168 locations. If the $1.4 billion transaction gets antitrust clearance from the Federal Trade Commission, the combined company would control some 15 percent of the U.S. industry, with much larger shares of prime markets in Florida, Texas, and California. In West Palm, a mecca for retirement (and therefore death), the Stewart merger would add a ninth business to the SCI stable, translating to more than 60 percent of the local market.

Explaining SCI’s business model, Zahn brakes the Cadillac in front of a large mustard-colored building that serves as the company’s regional embalming center. “Every body from every SCI home from North Palm Beach to Boca Raton comes here for embalming, and then it’s shipped back [to the funeral home] for the service,” Zahn says. “The families don’t know, but SCI saves a ton on overhead.” For cremations, SCI has a central oven facility in Fort Lauderdale. The chain’s locations share limos, hearses, and personnel. They enjoy volume discounts on caskets, flowers, and embalming fluid. “You feel like you’re competing against a factory,” Zahn says.

As uneasy as he is about SCI, Zahn and other small operators do cling to one competitive advantage: The chain charges customers more than independently owned rivals. Whatever cost savings SCI achieves, it keeps or passes along to its shareholders. Zahn recently cut his price for a no-frills cremation to $1,000. Nearby SCI-owned competitors using the central Fort Lauderdale facility charge $1,450 and higher. Nationally, SCI charges $3,396 on average for a cremation with memorial service—30 percent more than independently owned rivals, according to data compiled by Everest Funeral Package, a Houston-based “concierge” funeral planning service. For traditional funerals, SCI charges $6,256 on average (excluding casket and cemetery plot), 42 percent more than independents. “The SCI-Stewart deal may make sense at the corporate and Wall Street level,” says Mark Duffey, Everest’s chief executive officer, “but it’s not necessarily good news for consumers.”

SCI is already too big for its own—or its customers’—good, argues Josh Slocum, executive director of the Funeral Consumers Alliance, a nonprofit in South Burlington, Vt. The chain, he adds, generates “more consumer complaints than any other company we hear about.” SCI has also faced accusations over the years of shoddy cemetery practices that show disrespect for the departed. In a class action scheduled to go to trial in Los Angeles in November, plaintiffs allege that out of eagerness to jam too many coffins into a crowded memorial park, SCI employees damaged and desecrated existing graves.

The company denies any wrongdoing in the Los Angeles case and contests Slocum’s criticism. Pointing to overwhelmingly positive responses on customer surveys, SCI says it provides top value at a variety of funeral price points. Still, the consternation provoked by SCI’s expansion illustrates that the mass marketing of death care stirs an inherent fear that growth and profitability will come at the expense of families at their most vulnerable. With so much of American life being put through one or another corporate mill, the rise of SCI poses the question of whether it’s a good idea to corporatize death as well.

The $16 billion-a-year U.S. funeral industry comprises roughly 25,000 mostly small, family-owned businesses, but it’s consolidating with the spread of chains such as SCI and Stewart. Average profit margins are growing, according to research company IBISWorld, from 5.8 percent in 2008 to 6.5 percent in 2013.

Read the full article from Bloomberg Businessweek here: http://www.businessweek.com/articles/2013-10-24/is-funeral-home-chain-scis-growth-coming-at-the-expense-of-mourners