Hillenbrand Stock at 52 Week High, Others Not So Lucky

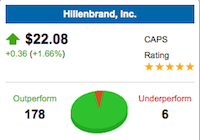

Hillenbrand (NYSE: HI) stock is currently (as of yesterday) at a 52 week high, closing at $22.08 a share. If fact many investors believe the stock will outperform the S&P 500 going forward.

Hillenbrand (NYSE: HI) stock is currently (as of yesterday) at a 52 week high, closing at $22.08 a share. If fact many investors believe the stock will outperform the S&P 500 going forward.

Other industry stocks are not faring so well. Shares of StoneMor Partners LP fell Tuesday as a Raymond James analyst downgraded the cemetery and funeral home operator following its fourth-quarter report.

Analyst John Ransom lowered his rating to “Market Perform” from “Outperform,” as StoneMor shares were trading above his price target of $20 per share. In afternoon trading, the stock skidded $1.81, or 8.6 percent, to $19.39 in afternoon trading. The stock is still trading near its year high of $21.44 set March 8.

On Monday, StoneMor reported a fourth-quarter loss and said its revenue declined, in part because of a lower death rate. The company lost $3.3 million, or 27 cents per share. It reported a profit of $1.5 million, or 13 cents per share, in the same period a year earlier. Revenue fell 5 percent to $44.2 million from $46.3 million.

The Levittown, Pa., company said revenue from cemetery merchandise and services fell, and it also took int less revenue from funeral home services. It also paid more to cover employee medical benefits because of higher costs and greater use.

Despite the downgrade, Ransom said he is optimistic about StoneMor’s prospects. He said the company’s financial position has improved.

Source: Business Week